Why are new medicinal products denied reimbursement in France?

- January 16, 2019

Many medicinal products looking to launch are rejected for reimbursement in France. A manufacturer must convince the Transparency Committee that their product is safe, effective and offers added value relative to alternative treatments for successful market access. In this blog, we summarise the reasons for negative reimbursement decisions in 2017 and discuss common pitfalls manufacturers should avoid.

The Transparency Committee and its role in reimbursement decisions

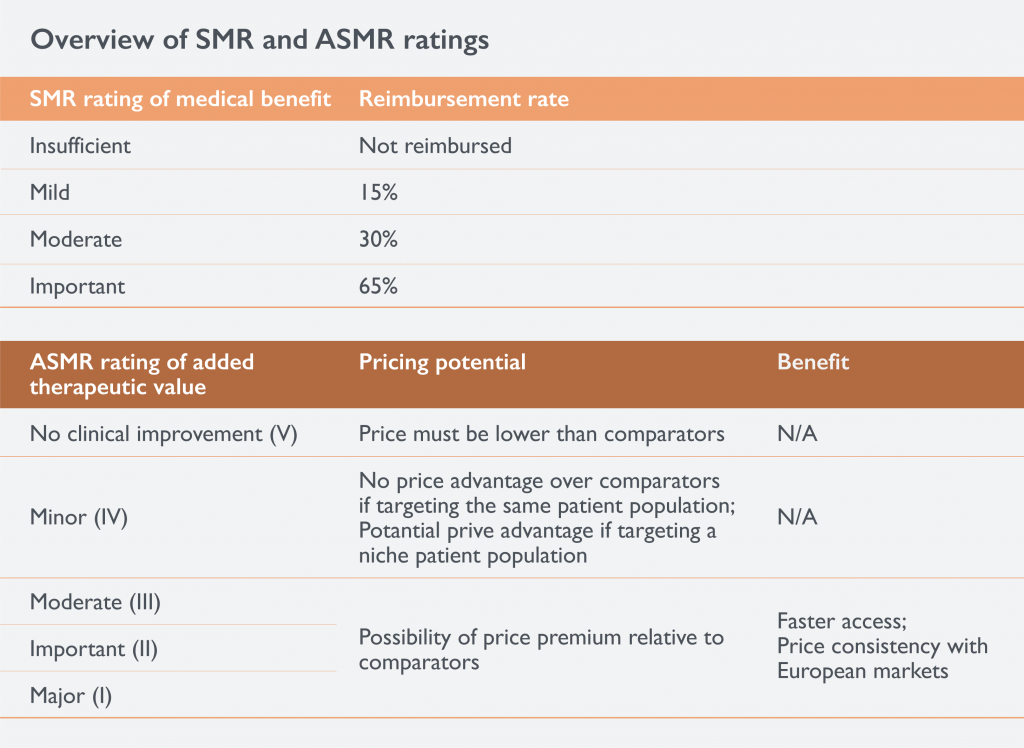

In France, the Transparency Committee (TC), part of the National Authority for Health (Haute Autorité de Santé), is responsible for assessing new medicinal products. The TC awards each product two ratings: one reflecting the product’s Actual Medical Benefit (SMR), which determines the reimbursement level, while the Improvement of Medical Benefit (ASMR), determines whether a price premium can be achieved or if a discount will be required.1

The SMR ratings, which are the focus of this blog post, are awarded based on a review of the severity of the disease, the medicinal product’s safety, efficacy/effectiveness and its potential to offer a preventative or curative, rather than just a symptomatic, treatment. When deciding the SMR rating, the TC also considers how the product compares to other available treatments and the impact reimbursement would have on public health. Drugs deemed to offer insufficient medical benefit are not reimbursed by the national health system while drugs rated as offering important medical benefits enjoy the highest reimbursement level.1

Reasons for not reimbursing new products

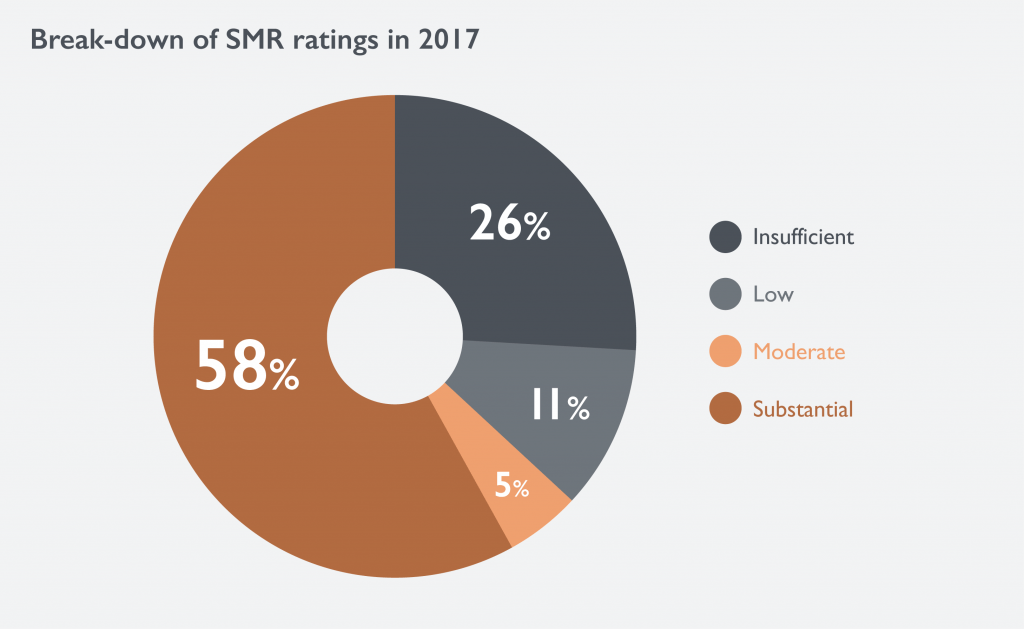

A review of all TC assessments published in 2017 found that approximately one-quarter of medicinal products were considered to offer insufficient medical benefit for them to be reimbursed in France.2

Efficacy and safety data were the top cited reasons for awarding an ‘insufficient’ SMR rating while concerns were also raised, relating to the design of the trials. Critique against trial design most frequently related to:

- Choice of comparator (e.g. relying on placebo-controlled studies despite active comparators considered more relevant to the care pathway having marketing authorisation when the clinical studies were conducted)3

- Critique against the type of clinical study used (e.g. use of open-label rather than blinded studies4

- Study population (e.g. uncertainty regarding the generalisability of the data to the wider patient population due to inclusion criteria employed in the trial).5

Implications for manufacturers and market access strategy

With just over one-quarter of reimbursement rejections, the proportion of new drugs deemed ‘insufficient’ is noteworthy. Failure to meet the desired efficacy or safety thresholds cannot, due to the nature of any scientific research, always be avoided. However, the risk may be mitigated by, for example, carefully weighing the risks and benefits of designing a trial to demonstrate non-inferiority versus superiority, or by considering how the number and order of endpoints will impact on the likelihood of demonstrating a statistically significant effect. Furthermore, once pivotal trial data becomes available, the proposed positioning of a drug should be reviewed and, if needed, adjusted to ensure there is a strong evidence base for its proposed place in the care pathway.

Critique solely relating to trial design can be avoided by ensuring a thorough understanding of the needs of payers versus regulators early in the product development. The TC’s focus is on understanding the added therapeutic value new drugs bring to patients, ensuring drugs that offer improved treatments are reimbursed and that their reimbursed price is linked to the level of improvement they provide relative to existing products.

This is different to the remit of regulators; while the European Medicines Agency (EMA) conducts a risk/benefit assessment based on efficacy and safety data that takes into consideration the availability of existing treatments and unmet needs, the TC’s focus is on comparative effectiveness. As a result, the TC and EMA will at times have different views on fundamental concepts such as the choice of clinical endpoints, efficacy versus effectiveness and the use of placebo/active controls.6 The high proportion of products considered ineligible for reimbursement in France – after having been deemed effective and safe by the EMA – suggest early product development must be conducted with not only regulators but also payers in mind.

Hence, similar to other markets, successful market access in France necessitates a thorough understanding of Health Technology Assessment (HTA) hurdles and the competitive landscape early in the product development, thorough market access planning and continuous fine-tuning of the market access strategy as new evidence becomes available in the final stages of the product development.

To understand more about how Valid Insight can support in trial designs with payers and market access in mind, contact us through discover@validinsight.com or call on +44 203 750 9833

References

- Haute Autorité De Sante. 2014. Available at: https://www.has-sante.fr/portail/upload/docs/application/pdf/2014-03/pricing_reimbursement_of_drugs_and_hta_policies_in_france.pdf [Accessed 20 December 2018]

- Murphy, EM et al. 2018. Available at: https://tools.ispor.org/research_pdfs/60/pdffiles/PHP213.pdf [Accessed 20 December 2018[

- Haute Autorité De Sante. 2017. Available at: https://www.has-sante.fr/portail/upload/docs/application/pdf/2017-11/stelara_mc_summary_ct15850.pdf [Accessed 20 December 2018]

- Haute Autorité De Sante. 2017. Available at: https://www.has-sante.fr/portail/upload/docs/application/pdf/2017-11/xultophy_summary_ct15551.pdf [Accessed 20 December 2018]

- Haute Autorité De Sante. 2017. Available at: https://www.has-sante.fr/portail/upload/docs/application/pdf/2018-04/nocdurna_summary_ct15793.pdf [Accessed 20 December 2018]

- European Medicines Agency. 2015. Available at: https://www.ema.europa.eu/documents/report/european-medicines-agency-road-map-2015-agencys-contribution-science-medicines-health_en.pdf [Accessed 20 December 2018]

- 0

- 0

- 0

Leave a Reply